- Bitcoin futures are in backwardation, inverting the basis trade that delivered risk-free returns.

- Analysts believe that unwinding the basis trade in part caused the sharp sell-offs last week.

- They explain whether the current setup is a sign of the bottom and the rebound is sustainable.

In the midst of the crypto boom that saw bitcoin surge to $63,000 at one point, traders were raking in double-digit risk-free returns by simply exploiting the difference between its spot price and futures contract price.

The so-called bitcoin basis trade bets on the cryptocurrency’s basis, or the premium of its futures price over spot price. For many crypto traders, bitcoin has been in contango for as long as they could remember, so they built a strategy that seeks to long spot bitcoin and short a distant futures contract.

Then, they simply wait for the two prices to converge and pocket the spread as the payoff. The nearly risk-less trade is an alluring attribute of the crypto market when bonds yield next to nothing and traditional banks could only offer a paltry 0.04% interest rate for the average savings account.

However, the trade has been inverted, at least temporarily, after the sharp and steep sell-offs in the last week.

For example, as of 1:10 p.m. ET on Tuesday, the bitcoin spot was trading at around $38,095 while its May and June futures contract price on the Chicago Mercantile Exchange was $37,965 and $38,015, respectively.

This means that the bitcoin futures price is trading at a discount to its spot price. In commodity-speak, bitcoin is in backwardation, which usually occurs when there is "a higher demand for an asset currently than the contracts maturing in the coming months through the futures market," according to Investopedia.

"If futures is less than spot, the market participants may be signaling a negative outlook on BTC because they are transacting for a cheaper price at a moment forward in time than it is right now," Justin Chuh, senior trader at digital asset investment manager Wave Financial, said in an e-mail interview.

Chuh recalled when the premium on bitcoin's June futures contract once peaked at 10% or 40% annualized, but it went inverted during the week. The narrowing of the spread isn't really supposed to happen until the last week of June, he said.

But backwardation usually doesn't last for too long, which is evidenced by bitcoin futures price fluctuating above and below its spot price on Tuesday. However, the temporary inversion of the basis trade could shed a light on why crypto bounced so quickly after a massive crash that knocked $1 trillion in value from the market in just 14 days.

What's behind the massive and rapid bounce?

As in typical crypto fashion, the market had a huge drawdown on Sunday that caught investors off guard. The volatility was so intense that even billionaire investor Mike Novogratz felt the need to put away his phone.

By Monday, that was all in the rearview mirror. Not only did bitcoin and ether bounce about 15% and 25%, respectively, yesterday, altcoins including Dogecoin also pared back their losses.

David Grider, lead digital asset strategist at Fundstrat Global Advisors attributed the rebound to two reasons.

One is the supply that comes from investors being nearly done with their unwinding of the cash-and-carry trade, which is another name for the basis trade. Because traders executing the strategy were effectively short futures, closing the trade means that they had to sell spot and close the futures positions.

"If folks are nearly done unwinding, it may have helped lower spot pressure and helped stop the bleeding on futures liquidations," Grider said in a Monday evening research note.

Make no mistake, the recent downward price movement has triggered a cascade of futures liquidations, with more than $20 billion liquidated in the past week alone, according to Sam Bankman-Fried, the chief executive of crypto exchange FTX. He also held the view that the market is stabilizing and recovering as liquidations are near an end.

Another reason is the demand from institutional investors. "We are hearing from trading desks that institutions are stepping in and buying higher quality blue-chip crypto assets at these levels," Grider said in the note. "We also think retail traders are entering the market and some are rebuilding leverage positions."

How sustainable is the upward move?

If leverage was one of the principal causes of the plummet of the crypto market, then a flush out of leverage would make the upward move more healthy and sustainable.

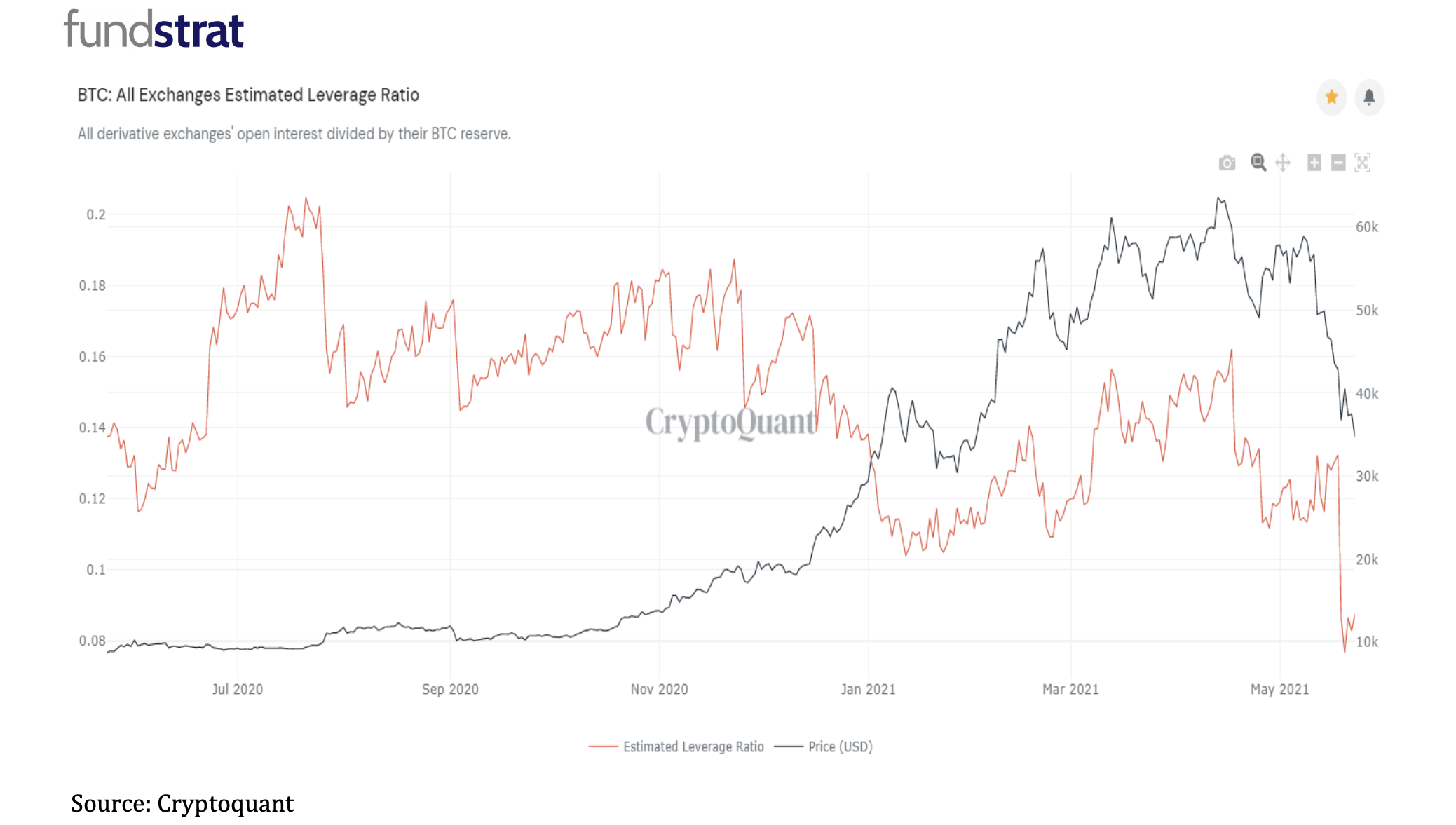

By using futures open interest against bitcoin holdings at exchanges, Grider believes that the data indicates "bitcoin hasn't been this de-levered the entire bull market run and leverage would have to double before getting back to where we were at bitcoin's all-time-high in April."

The chart illustrating the dynamic is shown below.

In Bankman-Fried's view, the leverage in the system is lower than it was pre-crash, with open interest on derivatives down quite a bit from before.

"My sense is that this is a lot of people, this isn't one big player getting liquidated," he told Coindesk at the Consensus 2021 conference. "This is 10,000 players with a $100,000 of positions each on average getting liquidated and the biggest players are $25 million, $50 million positions getting liquidated, and a few bigger than that, but that is not one player being half the total size here."

For Chuh, leverage still exists in the crypto market and will probably always be heavily used.

He notes that most traders use leverage on centralized exchanges such as Binance and like to trade 100 times larger than the cash they have on hand. Increasingly, with the rise of decentralized finance, investors are also "leveraging themselves by way of depositing assets into smart contracts and borrowing on those for further exposures."

As for whether the rebound is sustainable, perhaps Raoul Pal, founder of Real Vision and a former Goldman Sachs executive, said it best. He tweeted on Tuesday that despite having had a major Value-at-Risk shock test, there has been no systemic issue or contagion from the crypto drawdowns.

-Raoul Pal (@RaoulGMI) May 25, 2021